AXA Equitable RQMT 2012-2024 free printable template

Get, Create, Make and Sign

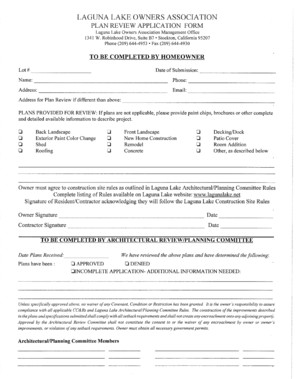

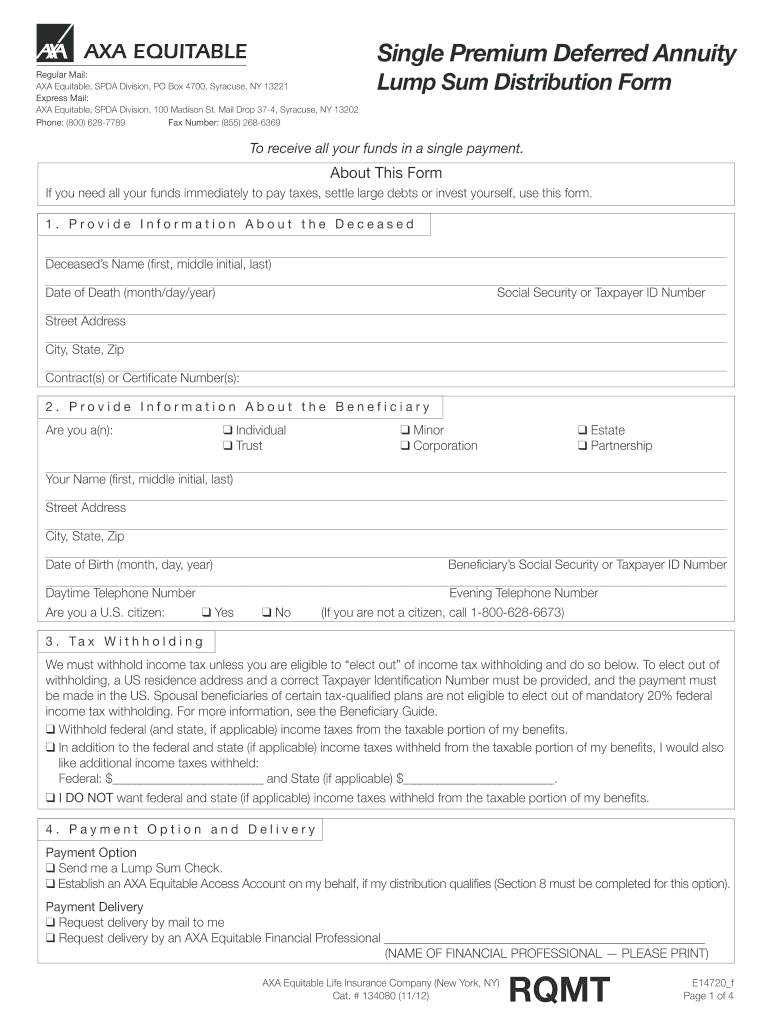

How to edit equitable beneficiary online

How to fill out equitable beneficiary form

To fill out the equitable beneficiary, follow the steps below:

Video instructions and help with filling out and completing equitable beneficiary

Instructions and Help about form make

Disruption in insurance if I look at you and me I would conclude disruption has not arrived yet in insurance I'm still wearing a tie you are not anymore if we look at disruption in insurance we are facing some really difficult challenges it starts with the question about our distribution historically we have very physical distribution the internet digital is often being as a threat, so the key challenge is how do we bring those two words together second challenge pricing historically we have a lot of data on our customers we don't use it we don't have the right people to make use of it and there's new data coming so digital means, so the big challenge is how do we make our data work and how do we combine it with data that comes from different sources of the internet search challenge our business model the business model is traditionally mutualization you have different risks everybody pays an average price and this enables us to pay for higher risk and also cover Laura's if with transparency on the internet in the digital world you are going to a face where everybody knows his or her own risk we will be faced with the challenge that mutualization is no longer possible because people who are good risk will demand lower prices and people who have difficult with situations will not be able to insure any more first challenge interaction traditionally insurance is salt, and then you see your customer in the worst case never again how will we make sure that we have more interaction to our customer that we incumbent we accompany our customer during its lifecycle Fifth's big challenge data security we have a lot of personal data we have very old legacy systems and there's a very high degree of cyber criminality how do we make sure that our old systems are stable and secure enough to withstand cybercrime if you take those five challenges that look what has the industry done so far you see that not much has been addressed the reason being we are focusing very much to dealing with your part with our past you've been reading about scandals in distribution you've been reading about difficulty on the IT and processing side, so we need to really work on our past to get it done and to be up to send it on the other hand we are very heavily involved with regulation solvency to is coming which means more capital which poses a lot of questions for a very large amount of insurance companies do we still exist tomorrow, and thirdly we've really been working in the digital world on making the old-timers that we have far more efficient which poses the question has it been the right investment to make a traditional business model automated and digital or should we sync somewhere else this is a great place then for new competitors to come in, and we slowly see it coming FinTech in insurance has been so far a word that I haven't heard very much but in the last half year to a year it comes more and more again and people are thinking about the question of how can we innovate...

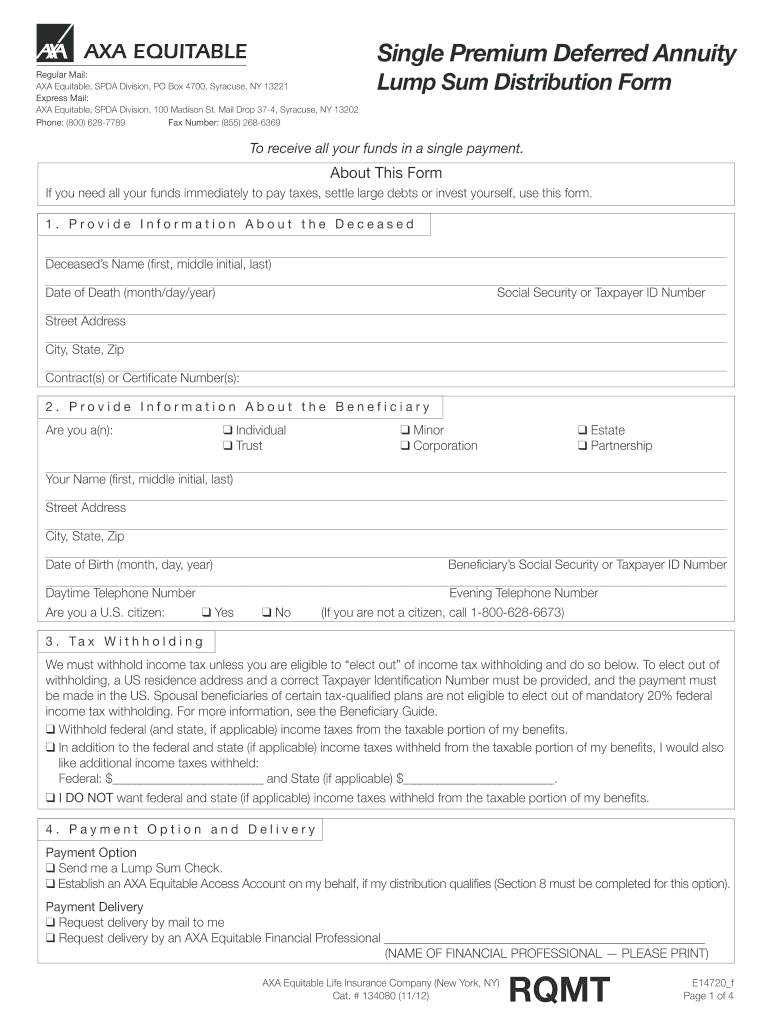

Fill axa equitable request for distribution form : Try Risk Free

People Also Ask about equitable beneficiary

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your equitable beneficiary form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.